Mistakes After An Accident – Avoid A Criminal Charge

Do not admit fault. If you are unsure as to who has “caused” the accident or will be considered at fault, be sure to call 911 so an officer can come to the scene. You can share what you know…

Do not admit fault. If you are unsure as to who has “caused” the accident or will be considered at fault, be sure to call 911 so an officer can come to the scene. You can share what you know…

If you were arrested in Silverdale for DUI or any other criminal charge, you were likely arrested by either a Kitsap County Sheriff’s Deputy (KCSO) or a Washington State Patrol Trooper. It is possible that a Bremerton Police Officer (BPD)…

The rules that apply to requests for expungement of non-conviction history or vacating conviction data in Kitsap County or Thurston County are the same rules that apply throughout the state of Washington. Can my criminal history “disappear” or be hidden?…

Why a private attorney? If you use a public defender, the benefit I am about to explain won’t apply because you won’t get an attorney assigned until the Arraignment. That is too late. No Bail Hold In Washington, if you…

Going to court is a little like going to church. If you can behave properly, everyone is welcome. It doesn’t matter if you came in your gym clothes or your Sunday best, most churches will welcome you. Think of court…

Assault charges with the special allegation of domestic violence are very common this time of year. Perhaps it’s the stress of finances or just spending too much time together, tensions are higher. Part of our job is to help the…

At Witt Law Group, we handle a lot of Assault–DV cases. The term domestic violence or DV is often used incorrectly. The actual charge in Washington is typically Assault Fourth Degree—DV. Domestic violence is a special allegation and the DV…

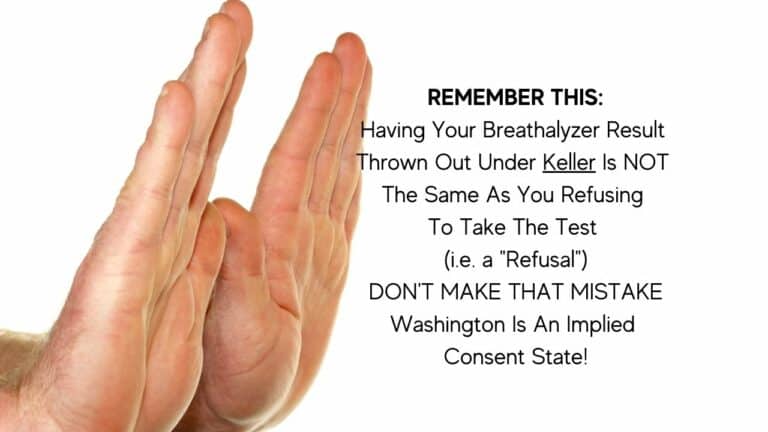

Well, it does not seem to be an abundance of dismissed cases. If you are facing a DUI or Physical Control charge, this might not be the information you were looking for. Multiple Prongs To The DUI Statute Since the…